michigan gas tax revenue

The Michigan Senate this week gave final approval to a bill that would suspend the states 272-cents-per-gallon gas tax for six months but the Republican majority did not have enough votes to give the bill immediate effect meaning it would not cut prices until 2023. When you create a MILogin account you are only required to answer the verification questions one.

Liquefied petroleum is taxed at 0263 per gallon.

. If you use Account Services select My Return Status once you have logged in. 0263 represented the Michigan gasoline tax 0184 represented the Federal gasoline tax and 0141 represented the Michigan sales tax. REVENUE SOURCE AND DISTRIBUTION.

SCHOOL AID FUNDReceives approximately 238 of gross collections per 2020 PA 75. Motor Fuel Tax Mi. Effective january 1 2012 the mbt was replaced with a 6 corporate income tax.

Account Services or Guest Services. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Prepaid rate on gasoline is 17.

Michigan Gas Tax Revenue Brochure Author. Prepaid Diesel Sales Tax Rate. Michigan Gas Tax Revenue Brochure Created Date.

Revenue from Michigans General Fund and School Aid Fund earmarked taxes totaled 26 billion in March 2022 up 733 from the March 2021 level. The federal gasoline tax 184 cents per gallon the michigan. Federal excise tax rates on various motor fuel products are as follows.

If a raw gallon of gasoline in Michigan was sold for 200 the taxes imposed on it include. Michigan per capita excise tax. You may check the status of your refund using self-service.

On top of other costs Michigan currently imposes a 19-cent per gallon excise tax on gasoline last updated in 1997 and a 15-cent per gallon excise tax on the in-state. 183 cents per federal excise tax. The 10 states diverting the largest percentage of their gas tax money.

0183 per gallon. In 2005 local governmental units in 9 states levied a local gasoline tax. Prepaid Gasoline Sales Tax Rate.

New York diverts 375 of its gas tax revenue Rhode Island diverts 371 New Jersey and Michigan divert 339 Maryland diverts 325 Connecticut diverts 27 Texas diverts 24 Massachusetts diverts 239 Florida diverts 136 and Vermont diverts 132. Michigan collects an average of 379 in yearly excise taxes per capita lower then 70 of the other 50 states. 2015 PA 179 earmarked 1500 million of GFGP income tax revenue to the Michigan Transportation Fund in FY 2018-19 3250 million in FY 2019-20 and 600 million in FY 2020-21 and each year thereafter.

Michigan General Excise Taxes - Gasoline Cigarettes and More Michigan collects general excise taxes on the sale of motor fuel gasoline and diesel cigarettes per pack and cell phone service plans. Includes revenue from the single business tax sbt michigan business tax mbt corporate income tax cit and insurance company premiums taxes revenues. Liquefied Natural Gas LNG 0243 per gallon.

Once the 6 percent sales tax is added which doesnt go toward fixing roads Michigan motorists would be paying 665 cents per gallon in state taxes at the pump in 2017 based on todays prices. There are two options to access your account information. 263 cents per Michigan motor fuel tax.

The revenue from this gas tax along with income tax revenue diverted from other programs would raise the proposed 14 billion each year. Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a current gas tax increase proposal is implemented.

Effective May 1 2022 the new prepaid gasoline sales tax rate is 255 cents per gallon. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents. The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per gallon equalizing both taxes at 263 cents per gallon.

Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote. Effective May 1 2022 the new prepaid gasoline sales tax rate is 216 cents per gallon. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to.

There are no toll roads in Michigan while 28 other states collect revenue from. Michigan is one of seven states that impose a sales tax on gasoline. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

Figure 3 Crude Oil 146 Refining 034 DistributionMarketing 035 Federal Motor Fuel Tax 018 Mi. But that was based on. 6 Other Taxes 0875 cpg for environmental regulation fee Diesel Tax rate is rate 6 local sales tax.

01 cents per Leaking Underground Storage Tank Trust Fund financing. The current federal motor fuel tax rates are. Fund 026 Michigan Sales Tax 014 School Aid Fund 0103 Const.

No local units in Michigan may levy a gasoline tax. Alternative fuels such as compressed natural gas liquefied natural gas hydrogen and hydrogen compressed natural gas are taxed at 0263 per gallon equivalent. 0219 gallon Most jet fuel that is used in commercial transportation is 044gallon.

This rate will remain in effect through May 31 2022.

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Senate Democratic Leader Unveils Gas Relief Counterplan

Michigan Gas Tax Going Up January 1 2022

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Creates Office To Navigate Emerging Tech In Transportation Transport Topics

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Whitmer Vetoes Suspension Of Michigan S Gas Tax Wrsp

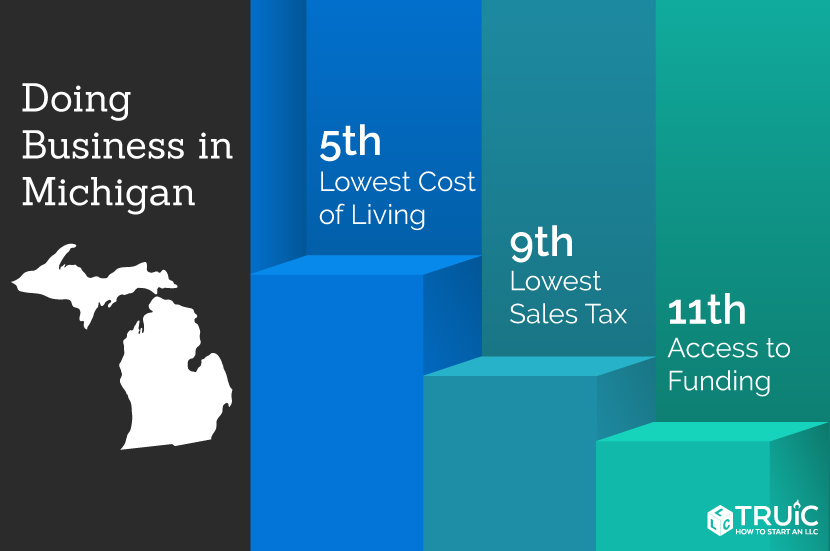

How To Start A Business In Michigan Starting A Business In Mi Truic

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Ranked 10th In Nation For Highest Gas Tax Michigan Farm News

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump